Understanding Personal Loans for Bad Credit

Figuring out personal loans when you have bad credit can feel stressful. A lot of people deal with this every day, so it's important to know what options you have.

If you have bad credit, you can still find personal loans. These loans usually have higher interest rates, but they can be a real help when money is tight.

A cosigner can make it easier to get a loan. If you know someone willing to help, this could boost your chances of approval.

Small loans for bad credit can help rebuild your credit and offer a stepping stone to better financial health.

Choosing the right lender matters a lot. Take time to research and compare different offers so you can find the one that fits your needs best.

If you work on raising your credit score, you’ll have a better chance of getting approved for loans and more financial options in the future.

This guide offers tips and advice to help you make smart choices about personal loans for bad credit. Let’s look at how these loans work and how they might help if you’re facing money problems.

Personal loans for bad credit are loans designed for people with poor credit scores. These loans allow borrowing despite previous financial setbacks. They stand apart from traditional loans due to broader accessibility.

Many lenders issue these loans to help build your credit over time. With careful repayment, you can strengthen your credit profile. This action paves the way for future opportunities.

Personal loans for bad credit can be used for various purposes. They might cover emergency expenses or help consolidate debt. Their flexible usage makes them appealing for many.

Some key features of personal loans for bad credit include:

- Higher interest rates compared to conventional loans

- Possibility of needing a cosigner or collateral

- Knowing about these features can help you make better choices. When you understand your options, you’re more likely to pick the loan that fits your needs.

Now that you know the features, it’s helpful to see how personal loans for bad credit actually work.

Personal loans for bad credit function similarly to regular personal loans but with tailored terms. They are designed to accommodate those with lower credit scores. Typically, they involve higher interest rates.

To begin, an application is submitted to a lender. This process might be completed online or in person. Lenders review your financial history, income, and other criteria.

Approval decisions often consider more than your credit score. Lenders review your employment status and outstanding debts. This thorough assessment can boost approval chances.

These loans usually involve smaller amounts than traditional loans. Lenders aim to reduce risk associated with poor credit. Repayment terms may be adjusted as a result.

Key factors in how these loans work include:

-

Higher interest rates to offset credit risk

-

Smaller loan amounts for manageable repayment

-

Flexibility in application and assessment process

Knowing about these factors can help you get ready and plan for what to expect.

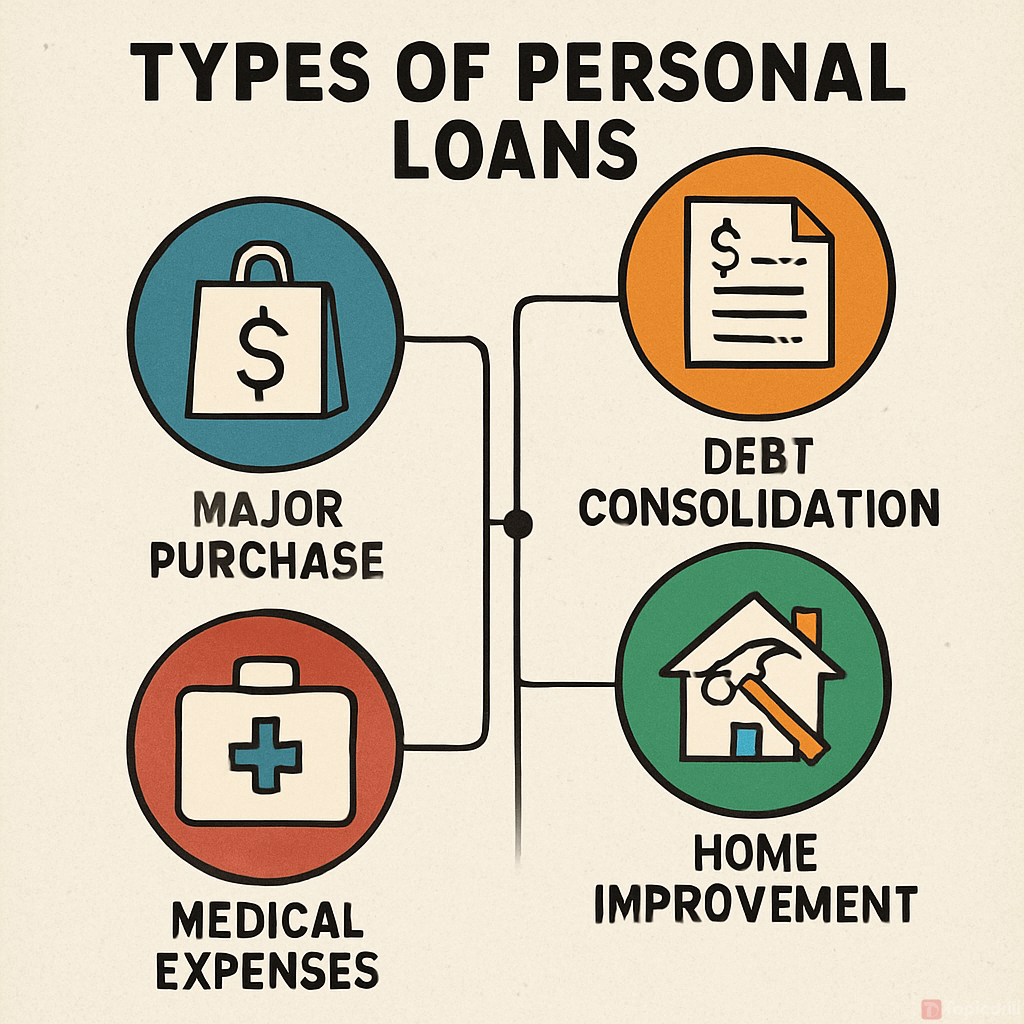

There are several types of personal loans available for people with bad credit.

Each one has its own pros and cons, so understanding the differences can help you make a smart choice.ps you decide wisely.

Unsecured Personal Loans: These do not require collateral. They often come with higher interest rates. Lenders consider them riskier due to the borrower's credit history.

Secured Personal Loans: Collateral like a car or savings account backs these loans. They typically have lower interest rates. The risk is lower for lenders, making approval easier.

Payday Loans: These short-term loans usually promise fast cash. They can carry extremely high fees. Thus, they might not be the best option for most individuals.

Credit Union Loans: Often, credit unions offer more favorable terms. They may be more willing to work with bad credit borrowers. Membership, however, is often required.

The types of personal loans for bad credit include:

-

Unsecured loans

-

Secured loans

-

Payday loans

-

Credit union loans

Each loan type has its place. Choose one that fits your ability to repay and your goals, and always make sure you understand the terms before you agree.

Pros and Cons of Bad Credit Personal Loans

When looking at personal loans for bad credit, it’s important to know both the good and the bad sides. Being aware of both can help you make a better decision. Here’s a quick look at each.

Pros:

-

Accessibility: Loans are available even with low credit scores.

-

Credit Improvement: Timely payments can boost your credit score.

-

Flexibility: These loans often have no restrictions on usage.

Cons:

-

High Interest Rates: Borrowers face steeper rates compared to those with good credit.

-

Fees: Additional costs and fees may apply, increasing the loan's total cost.

-

Risk of Debt Cycle: High costs can trap borrowers in debt. Take time to weigh the pros and cons, think about your finances, and make sure you can handle the payments before taking out a loan.

How to Qualify for a Personal Loan with Bad or No Credit

Getting a personal loan when you have bad or no credit isn’t always easy. But if you know what’s needed and get ready ahead of time, you can improve your chances of being approved.

Start by reviewing your credit report. Knowing your credit score gives you insight into potential challenges. This step is crucial before approaching lenders.

Next, gather essential financial documents. Lenders typically require proof of income, employment details, and identification. Preparing these documents in advance accelerates the application process.

Try connecting with local banks or credit unions. They often give more personal service and might be more flexible about credit than big banks.

Enhance your financial profile by paying down existing debts and, if possible, increasing your income. Demonstrating responsible financial behavior can boost lender confidence.

Here's a quick checklist to get started:

-

Review your credit report.

-

Prepare necessary financial documents.

-

Establish relationships with local lenders.

-

Improve financial behaviors and pay down debts.

-

Explore secured loan options.

Having bad credit can make getting a loan tougher, but it’s not impossible. If you get ready and check the terms carefully, you can find a loan that helps you reach your goals without putting your finances at risk.

Where to Find Personal Loans for Bad Credit

If you have bad credit, finding a personal loan takes a bit of research. There are lots of lenders out there, but not all of them are a good fit for your situation.

Start your search online for lenders who specialize in loans for bad credit. Many online platforms provide flexible terms and quick approval processes, making them a convenient choice.

Credit unions are another option. They often provide more personalized services than large banks. Their terms might be more favorable for individuals with poor credit.

It’s important to look at different lenders so you can find the best rates and terms. Here are a few places to start your search:

-

Online lenders specializing in bad credit loans.

-

Local credit unions with flexible credit terms.

-

Community banks willing to work with credit challenges.

-

Peer-to-peer lending platforms offering alternative solutions.

by James Smith (https://unsplash.com/@anthonyjames_f8)

Make sure to check if a lender is trustworthy before you agree to anything. Taking the time to do your homework can help you avoid scams and bad deals.

Same Day Loans, Small Loans, and No Credit Check Options

Sometimes you need money quickly. Same day loans can help in these situations, often getting you funds within a few hours or days.

Small loans are another option for those with limited borrowing needs. They can be useful for unexpected expenses. However, they may come with higher interest rates.

No credit check loans offer another path to quick cash. These loans skip traditional credit assessments, allowing easier access for those with bad credit.

Here are some options to consider:

-

Same day loans from online lenders.

-

Small loans for specific urgent needs.

-

No credit check loans from alternative financial services.

Same day, small, and no credit check loans can be useful in emergencies, but watch out for the risks. Always read the details and check the costs so you can protect your finances.

The Role of Cosigners and Joint Personal Loans

If your credit score is low, getting a loan can be tough. Having a cosigner, someone who agrees to pay if you can’t, can help you get approved and may even get you better terms.

Another option is a joint personal loan, where two people apply together and share responsibility. This can sometimes get you better loan terms, especially if the other person has good credit.

Consider these key aspects about cosigners and joint loans:

-

A cosigner can help improve your chances.

-

Joint loans share financial responsibility.

-

The cosigner's credit can affect loan terms.

A cosigner can help you get approved, but both of you share the risk. Make sure everyone understands what’s involved before moving forward to protect your relationship and credit.

How to Get a Personal Loan Without a Cosigner

You can get a loan without a cosigner, but you’ll need to show good financial habits. Having steady income and a record of paying bills on time really helps.

Boosting your credit score can improve your chances significantly. Lenders want assurance that you can repay without help. Various strategies can strengthen your application.

Consider these strategies for securing a loan solo:

-

Improve your credit score before applying.

-

Show proof of reliable income.

-

Consider secured loans using assets as collateral.

If you’re applying for a loan by yourself, look for lenders who are open to working with people who have poor credit. Be honest on your application and try to improve your finances before you apply.

Steps to Improve Your Chances of Approval

Raising your credit score can really help you get approved for a loan. Even small improvements matter. Check your credit report often and fix any mistakes you find.

Showing that you have a steady job and regular income is important to lenders. Keeping your debts low compared to your income also makes you look like a safer bet.

Consider these steps to boost your approval chances:

-

Pay bills on time to establish a good payment history.

-

Reduce existing debt before applying for new loans.

-

Limit new credit inquiries and accounts within a short time frame.

Taking these steps can make your application stronger. The more reliable you seem, the better your chances of getting approved.

What to Watch Out For: Risks and Red Flags

If you’re looking for a personal loan with bad credit, watch out for common problems. High interest rates and extra fees can make these loans much more expensive over time.

Be careful of lenders who don’t have your best interests in mind. Some offer no credit check loans with very high rates and hidden fees. Always read the terms closely and don’t rush into a decision.

Watch for these red flags:

-

Lenders demanding upfront fees or personal information.

-

Promises of guaranteed approval without assessing your financial situation.

-

Vague or complex loan terms that are hard to understand.

Watching out for warning signs can help you avoid money troubles later. Make sure you fully understand any loan before you agree to it.

Alternatives to Personal Loans for Bad Credit

If personal loans feel too risky, look into other choices that might work better for you. Credit unions often have better terms and more personal service than big banks, and they might be more flexible about who they lend to.

Here are some alternatives worth considering:

-

Peer-to-peer lending: Often features competitive rates.

-

Secured credit cards: Useful for building credit responsibly.

-

Family or friend loans: May come with lower or no interest.

Take time to look at all your options and pick the one that fits your needs and budget. The best choice is one you can pay back comfortably.

Frequently Asked Questions

Can I get a personal loan with no credit history?

Yes, but expect higher interest rates. Lenders view no credit history as risky, impacting your loan terms.

What should I look for in a lender?

Check interest rates and hidden fees. Reputation matters too; read reviews before committing.

Is it possible to get a loan without a cosigner?

Absolutely. Though harder, many have succeeded by improving their creditworthiness or opting for secured loans.

How quickly can I receive funds after approval?

Some lenders offer same-day disbursement. Others may take a few business days.

Will applying for loans impact my credit score?

Yes, multiple hard inquiries can affect your score. Space out applications to minimize impact.

What are secured loans?

These loans require collateral. They're easier to get if you have bad credit but involve more risk.

Conclusion: Making the Right Choice for Your Situation

Getting a personal loan with bad credit takes some research and careful thinking. Make sure you know your options and understand the terms of any loan you consider.

The best way to handle personal loans with bad credit is to make smart, careful choices. Work on improving your credit, know the loan terms, and only borrow what you can afford to pay back.